April 23, 2021

ESG investing gains ever more momentum in Japan

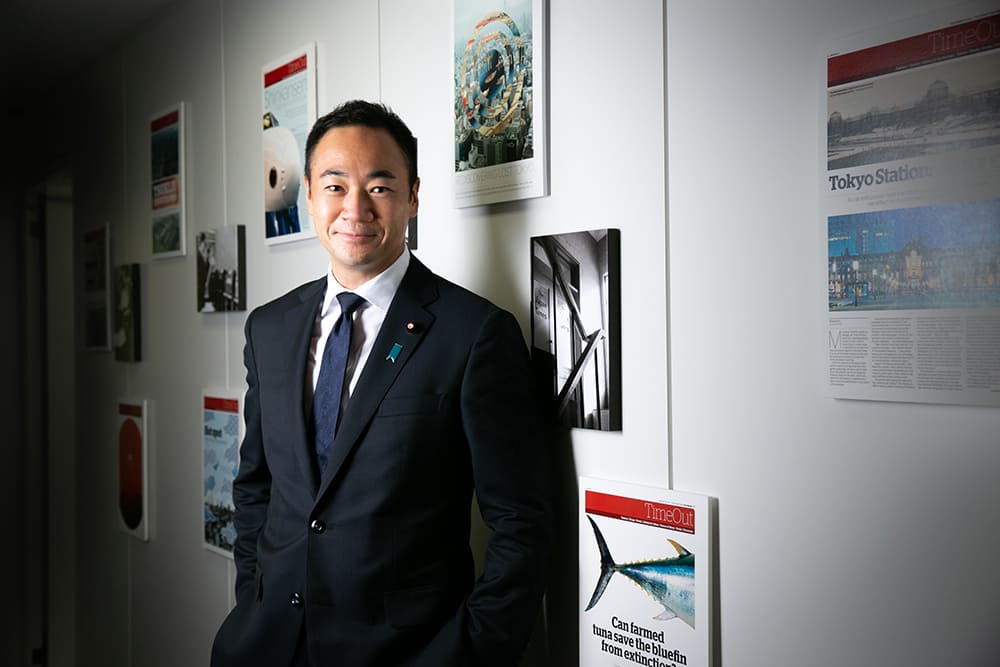

Contributing writer

While working for the Ministry of Finance, Hideki Takada launched the Green Finance Network Japan in September 2018. Starting with just a few members, the group’s activities grew fast as interest in green finance and ESG (environmental, social and governance) investing grew.

It now includes over 250 members from more than 130 private and public entities, including central government bodies such as the Ministry of Finance, the Financial Services Agency and the Ministry of the Environment as well as financial institutions, institutional investors and businesses.

“Green finance” refers to efforts to promote financing or investing activities aimed at realizing sustainable economies and societies. Although the GFNJ is often discussed today, at the time it was launched there were few frameworks giving people in the public and private sectors, or those in Japan and abroad, opportunities to work together, according to Takada.

Determined to create such a framework, Takada, who also has been involved in green finance at the Organisation for Economic Co-operation and Development’s secretariat since 2015, started to seek potential members to form what would become GFNJ. He successfully brought on board the leading figure in green finance in Japan, Takejiro Sueyoshi, and his former boss at the OECD, Rintaro Tamaki, a former vice minister of finance for international affairs.

GFNJ spreads the word

GFNJ is an “informal gathering” of people committed to the cause who participate “in their capacity as a private person,” according to Takada. Exchanging information between members and organizing events are the main activities of the group. Symposiums it organized in 2018 and 2019 each attracted about 200 participants. Environment Minister Shinjiro Koizumi sent a video message to another symposium in 2020, which was held online amid the coronavirus pandemic.

GFNJ has worked with stakeholders around the world. In 2019, for example, it helped organize an event cosponsored by the Tokyo Metropolitan Government and the British Embassy in Japan. It also cosponsored a seminar with the Climate Bonds Initiative.

In Japan, “there are increasing moves among institutional investors, such as pension funds, to promote ESG investing,” according to Takada. This has been driven by a 2020 revision to the basic policy for pension reserves making it “mandatory, in a sense, (for public pension funds) to commit to ESG investing,” Takada said.

The Finance Ministry has called on the Federation of National Public Service Personnel Mutual Aid Associations, also known as KKR, to commit to ESG investing. KKR has said it will ask all its asset managers to weigh ESG factors in investment decisions and will study the possibility of becoming a signatory of the U.N.-supported Principles for Responsible Investment (PRI). The federation also said it will start preparing to endorse the information disclosure recommended by the Task Force on Climate-related Financial Disclosures (TCFD). “If the asset owner (KKR) takes action, it can create a chance for Japan’s investment chain (flow of money) to change,” Takada said. “In particular, moves by a public pension fund have a strong potential to influence the market.”

‘Awareness shift’ in 2015

Takada said there was an “awareness shift” in the world in 2015 in which financial authorities and institutions started to consider climate change as an economic issue.

In September of that year, Mark Carney, at the time the governor of the Bank of England and chairman of the Financial Stability Board, warned about the risk posed by climate change to financial markets in a speech to financial industry insiders, and the United Nations adopted the Sustainable Development Goals (SDGs).

In December, the Financial Stability Board established the TCFD, and the Paris Agreement was reached at the 21st Conference of the Parties to the U.N. Framework Convention on Climate Change (COP21). At the finance track of the Group of 20 in 2016, host country China set up the Green Finance Study Group. This has “left no choice” for financial and monetary authorities — as well as central banks, which had not been directly involved in environmental and climate issues — but to be involved in discussion of these issues, Takada said.

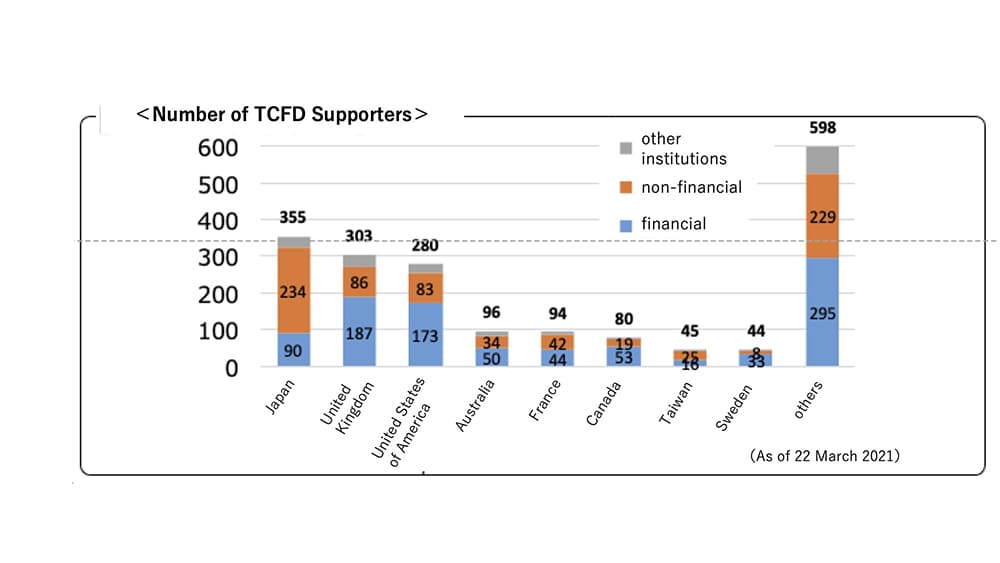

Moves to regard climate change as an economic and financial issue have gained momentum in the past few years. The information disclosure recommended by the TCFD had been endorsed by over 1,700 entities around the world by the end of January. Notably, the number of such entities in Japan was the largest, totaling over 300. The European Union has been working to develop a “sustainable finance market” and in 2020 announced the “taxonomy,” a classification system to determine whether an economic activity is environmentally sustainable.

The rest of the world now faces the difficult choice of whether to follow the EU, which leads the way in introducing regulatory systems, or create their own standards, according to Takada.

Japan’s potential

Japan is host to financial assets whose total size is one of the world’s largest and has a mature financial market, but the country was undeniably behind Europe and the United States in terms of green finance awareness and commitment. But this may also mean the country’s significant potential has yet to materialize.

In 2015, when the Japanese Government Pension Investment Fund, one of the world’s largest pension funds, became a signatory to the Principles for Responsible Investment, the news was perceived by people involved in promoting green finance around the world as “the first step taken by the sleeping lion (Japan) that has been awakened,” Takada said.

After this, there were few notable moves until 2017, when new initiatives began to emerge. The Tokyo Metropolitan Government issued green bonds, becoming the first Japanese local government to do so. Japan’s Financial Services Agency joined the network of central banks and financial authorities around the world in 2018, followed by the Bank of Japan in 2019.

“The Japanese are not good at taking the first step, but we have the potential to change quickly, like an avalanche, once we start to move,” Takada said. “In Japan, developments in the green finance market have happened quickly in the past few years compared to the global standards.”

In late 2020, Prime Minister Yoshihide Suga said Japan aims to become a carbon-neutral society by 2050, and this policy speech may give momentum to policies to promote green finance.

A major question for the global community ahead of the 26th U.N. Climate Change Conference of the Parties (COP26) in November is “whether Japan can present a persuasive goal and drive forward discussions about it,” Takada said.